Top Altcoins on the Market (PartⅠ)

2021-04-18TOP Altcoins Privacy Coins (Part Ⅲ)

2021-04-22Top Altcoins DeFi Mania Winners (PartⅡ)

Our previous mini article about TOP Altcoins started a mini-series that we decided to dedicate to interesting cryptocurrency projects.

Ethereum, Cardano or Litecoin were around for a while now and have become some of the most likable cryptocurrencies to date. Already, they have made a huge impact on their overall direction.

Decentralised finance (known as DeFi) is a concept that arose from the cryptocurrency world, which is used to describes a blockchain-based form of finance that does not rely on any central financial intermediaries such as banks, brokers or exchanges (hence, it is not centralised). The goal of DeFi is to offer products and services that are similar to those of centralised financial system, however, without the need of third parties, solely through the utilisation of smart contracts and blockchain technology.

Most commonly used platform for building DeFi is Ethereum, with more than 80 % of all DeFi projects being built on the second biggest cryptocurrency (Ethereum DeFi Ecosystem, 2021). The whole sector is gaining more and more attention, with Total Value Locked (TVL), one of the most important indicators of DeFi, being at its ATH at the level of 51 billion dollars. Only 6 months ago, this value was about 10 billion dollars and 12 months ago well below 1 billion dollars. This steep rise portrays the importance of the DeFi, which is one of the reasons why we have dedicated this article to the most important DeFi projects in the cryptocurrency world (Defi Pulse, n.d.).

Uniswap (UNI)

Uniswap is one of the renowned and iconic DeFi projects.. The whitepaper of the Uniswap project was published in November 2018, with Hayden Adams being its creator. As with a vast number of DeFi projects, Uniswap was little known before 2020. Once it was widely used, it immediately became the most important decentralised exchange (known as DEX). Uniswap’s market capitalisation is about 15 billion dollars which ranks it as the 8th biggest cryptocurrency (Uniswap, n.d.).

However, the trading volume of Uniswap is around one billion dollars a day, with the overall liquidity rising to almost 8 billion dollars. As an exchange, Uniswap creates a whole new world for swapping and trading cryptocurrencies. In the nature of decentralised finance, the platform works without the need of creation of any account, KYC or AML regulations due to the simple connection with different wallets (such as Coinbase Wallet or Metamask).

Liquidity of Uniswap, Source: Uniswap.org

Uniswap is a decentralised, automated market making exchange that provides liquidity through liquidity pools (known as LPs), where users can exchange their ERC-20 tokens between two different assets. This simply means, that there is no order book in the Uniswap exchange, rather there are created with different pools, This allows users to exchange the tokens while liquidity providers earn fees. To put in simple terms, when you use Uniswap for trading you choose a market pair you want to trade or you select the cryptocurrency you want to sell (USDT for example) and you choose the cryptocurrency you want to buy (ETH for example). The exchange will do it without any need of verification, usually almost immediately and in an ideal case with very little slippage (low transaction fees).

The market capitalisation of Uniswaps´ UNI token is steadily rising ever since its airdrop, back in September 2020. UNI token is also one of the great indicators of how well this DEX is used or perceived. With the initial price of around 2-3 dollars, the current price of 30 dollars clearly shows how much potential is believed to be hidden in this DEX gem.

Sushiswap (SUSHI)

Uniswap is not the only decentralized exchange in the sector. On contrary, the competition for Uniswap rises almost every single week, with more DEXes coming with different incentives for users. One of the very first ones, and still one of the biggest competitors of Uniswap is its fork, Sushiswap (SUSHI). This decentralized exchange was created only at the end of August 2020. This exchange was able to rise extremely fast due to its similarities to Uniswap, and SUSHI token as well as its ability to give incentive to liquidity providers to move from Uniswap to Sushiswap. (Sushi, n.d.)

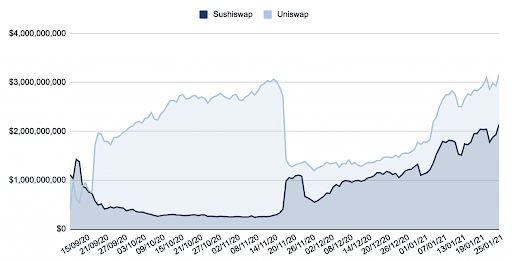

Sushiswap, developed by an anonymous person known under the name of “Chef Nomi,” is a rather controversial DeFi project due to several events. Its beginning was very strange and is still viewed as a rather unorthodox way of being introduced in the crypto space. Sushiswap was created as a fork of Uniswap, however, it used a so-called “vampire attack.” This basically meant that at the beginning, both exchanges were almost identical (due to code of Uniswap being open-source). Nonetheless, Sushiswap allowed liquidity providers of Uniswap to migrate onto Sushiswap exchange and earn a brand new tokens, SUSHI. Since Uniswap did not have its own tokens at that time, many people migrated to Sushiswap, essentially slamming the liquidity of Uniswap and skyrocketing the liquidity of Sushiswap. This happened at the beginning of September 2020 and this was the only time when Sushiswap had a higher liquidity and Total Value Locked than Uniswap (Defi Pulse, n.d.).

Liquidity comparison of Uniswap and Sushiswap, Source: Medium.com

However, these two projects are still very similar. The biggest differences should appear this year, when both DEXes have planned several different upgrades and implementation of new features, which will likely separate their functionality. One of the key new features that Sushiswap is going to introduce is called MISO (short for Minimal Initial Sushi Offering). MISO will serve as a platform for support and initialization of new projects. Moreover, Sushiswap is also looking to add more trading features and have decided to create a new liquidity pool – Deriswap. Deriswap should serve all traders that are willing to trade swaps, futures, options or loans.

All expected upgrades, such as MISO, Deriswap, Mirin, BentoBox or Multichain Communication in combination with established community and support of projects such as Yearn.Finance are reasons, why it is highly unlikely for this platform to lose its stance, even with new competitors penetrating the market.

Aave (AAVE)

DeFi world is not only about different decentralized exchanges though. On the contrary, it is a much more complex and fascinating world that tries to eliminate the middleman and third-party products and services from the traditional finance world. This is also a reason why projects such as Aave have been created. Aave is described as “an open source and non custodial liquidity protocol for earning interest on deposits and borrowing assets.” In simple words, Aave can be thought of as a system of lending pools, where users can lend money and earn interest on them, or from which users can borrow money all without the need of a third-party provider or a trusted intermediary. When using Aave, the only thing you need to trust is a code and its execution. This is also why in the DeFi world, Aave is not thought of as a DEX, but rather a lending and borrowing protocol.

The most basic feature of the Aave is its borrowing and lending capabilities. Users deposit funds they wish to lend, which are collected to create a pool. In return, the lenders receive an interest rate, depending on the size of the pool and the given cryptocurrency. These pools are then used by borrowers, who may withdraw assets from these pools in a form of loan (what is AAVE Lend, n.d.).

Notably, this platform offers more than you can bargain for. Other than flash loans, which are popular types of DeFi loans that happen almost instantly and do not require an upfront collateral, Aave also offers rate switching, unique collateral types or Aave Pay and Aave Governance. These are all different features that help this project to have a market cap of around 5 billion dollars, with more than 6.11 billion dollars in Total Value Locked (AAVE Review, n.d.).

Bingbon and DeFi Projects

Bingbon is well aware of DeFi mania connected these projects, and also hundreds of others. We value the uniqueness and applicability of solutions, which is one of the reasons why two of the above-mentioned projects can be traded also via our platform. Uniswap and Aave are paired with Tether (UNI/USDT and AAVE/USDT), with high liquidity for all of these projects, signifying the clear trading demand for them. This only shows that these projects are becoming more popular hence why they remain a stable part of our portfolio of trading pairs.

Reference

Ethereum DeFi Ecosystem. (2021). Retrieved from Defiprime: https://defiprime.com/ethereum

what is AAVE Lend. (n.d.). Retrieved from Kraken: https://www.kraken.com/learn/what-is-aave-lend

AAVE Review. (n.d.). Retrieved from Defirate: https://defirate.com/aave/

(n.d.). Retrieved from Uniswap: https://info.uniswap.org/home#/

(n.d.). Retrieved from Sushi: https://sushi.com

(n.d.). Retrieved from Defi Pulse: https://defipulse.com